Customer service may vary from industry to industry, but the fundamental basics are the same—to provide the best level of experience you can to your customers.

In the finance industry, there is very little to choose from in terms of different organizations.

One way to make your company stand out in this commoditized space is by providing the best customer service that you can.

Technology in the financial industry is continually evolving and growing.

In the same manner, financial service customer service has to keep pace with the changing industry standards.

With the digitization of mostly all industries, financial services customer support also has to change and grow with the industry.

It has to equip itself to handle both real-life and digital interactions. This is especially true after the COVID-19 pandemic, after which customers have opted more for online transactions.

The importance of customer service in financial services

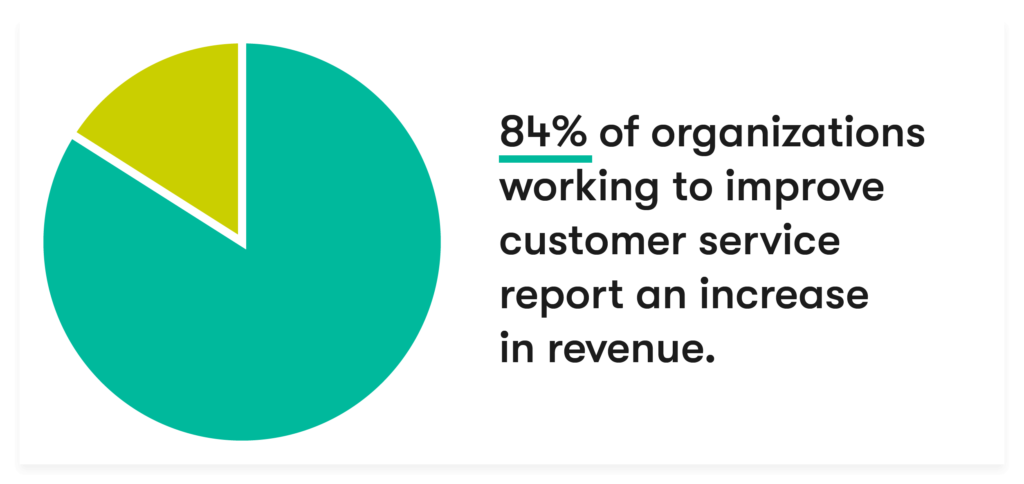

As stated above, financial organizations have realized that the products and services they offer are more or less the same as those provided by other organizations and institutions.

For your company to stand out from the competition, it has become a very important strategy to focus on providing high–quality services to your customers.

To achieve this goal, you must give priority and focus on the points below:

- Detailed understanding of your customers’ needs and expectations

- Well-trained and well-versed service agents to explain the product/service to the customers

- Provide quality service in a timely manner

- Build a team of professional but “human’ customer service agents

Image source: www.groovehq.com

Image source: www.groovehq.com

Listed below are 20 service tips for enhancing your financial services customer support strategy

20 Customer Service Tips for Financial Services Industry

1. Create a positive first impression

Making the customer feel at ease and comfortable can be the deciding factor on whether you gain their business or not.

Simple things like a warm smile and genuine compliments go a long way in creating a positive first impression on your customers.

2. Product/service knowledge

Your customer service agent should be well versed with the products and services that your company has on offer.

The agent should be able to talk about the benefits and features of your products/services and be able to make informed recommendations to the customers.

Updating and refreshing your customer service agents regularly about your company’s products will empower them to give clear and concise information to customers.

Utilizing a KMS (Knowledge Management System) can work wonders for keeping your customers and agents updated on all your products and services.

3. Clear communication skills

Communicate clearly and transparently with your customers, this is very important when you’re providing customer service in financial services.

Try to avoid using technical terms during your interactions with customers. Check with them time and again to see if they’re following what you’re trying to tell them

Make sure that they understand the implications of their decisions and don’t blame you later for any adverse results.

It is always good practice to document all interactions with customers for future reference.

Image source: haiilo.com

4. Empower your service agents

Empowering your service agents by giving them as much autonomy as can be allowed is a must for customer service in financial services.

Autonomy instills confidence and responsibility in your service agents as well as builds trust between them and your customers.

Empowered service agents are able to solve problems and resolve issues on the spot which will make the customers’ trust the agent some more.

5. Develop interpersonal skills

While most people are opting for the convenience of online transactions there are still some who prefer to conduct in-person transactions.

Your service agents should have the skills to welcome these customers with a smile and a positive attitude.

The ability to deal courteously and be friendly with customers can gain you a loyal customer.

It is good practice to also conduct not just technical training but also training and workshops on developing soft skills for your service agents.

6. Develop personal skills

Your personal skills are as important as your interpersonal skills.

Being able to empathize with your customers, listen to them actively and be able to converse with them concisely will make your customers feel good and well taken care of.

7. Improve tech-literacy

As technology drives most businesses in one way or another, it is imperative that your customer service agents know about the tech being used by your organization.

Your service agents should be able to disseminate the information to the customers.

For example, if your organization has an app, it would be enhancing the customer experience if your service agents could guide your customers through its workings.

You could utilize LMS (learning management system) to conduct training to keep your customer service agents abreast of advancements happening in your company.

8. Have specialist agents

Customers today are more tech-savvy and usually know what they want.

They want customized advice that will be relevant to what they’re looking for.

It can be a daunting task for your service agents to offer such personalized advice to all of your customers.

Having agents that specialize in different areas like loans, investments, insurance, etc. is a more efficient way to better serve your customers.

9. Incorporate data for enhancing the customer experience

Use all available data of customers gathered from different departments like marketing, sales, customer service, etc. to create individual customer profiles.

These profiles can then be used to provide tailor-made customer service in financial services for your customers.

The best source for gathering data to create customer profiles is CRM (Customer Relationship Management) software.

A CRM can be used to gather data on customer demographics, purchasing behavior, and social media activity.

At the same time, helpdesks (customer service centers) integrated with the CRM can be used to track their post-purchase interactions and service requests.

Analytical tools can then be used to create a fuller and richer customer profile which can be invaluable for creating targeted marketing campaigns.

10. Develop omnichannel communication

With every new online channel, the way customers can communicate and interact with you grows.

Facebook, Instagram, email, SMS, chats, telephone, etc. there are innumerable ways customers can get in touch with you.

Investing in a system that can interact with your customers through whichever channel is convenient for them is a good financial service customer support strategy.

11. Self-serve services for your customers

Self-serve services can help your customers find information, troubleshoot problems, and find answers by themselves.

This service can reduce wait times and be available 24/7. It can also help your service agents by reducing their call volumes.

12. Personalize the customers’ journey

Utilize the customer profiles generated for not only marketing campaigns but also to personalize the customer’s journey.

Data can help predict needs before they arise. Pre-filling of forms, payment reminders, loyalty program rewards, special offers, etc. can be customized as per the customers’ convenience thus enhancing the customer experience.

13. Human touch technology

Technology is accurate and efficient but it lacks the ‘human element’.

In its interactions, it comes across as cold and clinical.

Respect, flexibility, and empathy are customer service traits that your customers would like to see during an interaction.

Combining and balancing the effectiveness of technology with the human traits of a service agent will make for a positive customer experience.

14. Build trust

This is an important step for financial services customer service. The customers must have trust in you to manage their finances.

To build that trust you should:

- Keep the customer at the core of all interactions

- Reassure them about the security measures followed by your company

- Be transparent about all products and services

- Be honest about what can be done and what can’t

- Ask for feedback and act on the insights

- Communicate proactively

- Be reachable as much as you can

- Cultivate your relationship

Kapture CRM UI and APIs are encrypted via industry-standard HTTPS/TLS over public networks. This makes sure that all traffic between you and Kapture CRM is safe during transit.

You can further reassure your customers about their data security by mentioning how Kapture CRM follows the GDPR (General Data Protection Regulation) guidelines.

Since the FinServ and FinTech industries are so prone to fraud and hacking attempts, It helps if you have a specialist with a cybersecurity degree on your customer service team. Keeping with the advice in point #8 above, they can assist customers who have been subjected to a phishing or hacking attack and reinforce the trust value that your business provides.

15. Ask for feedback

As mentioned in the above point, asking for feedback is an important way to gather customer insights for your products/services.

Those insights will let you improve and upgrade your products which will be beneficial for the customer and you.

Knowing that their feedback is appreciated and acted upon will generate more trust and loyalty from your customers towards your company.

Image source: www.engati.com

16. Address customer pain points

This is one point if not given priority and acted upon can lead to customer churn.

The best way to resolve pain points is to listen to your customers and look at fixing them from a customer’s perspective.

There are two major customer pain points in customer service in financial services:

- Lack of proactive, informed customer service

The sheer volume of different channels of communication makes it difficult for an agent to anticipate customer wants and expectations.

Utilizing omnichannel support systems can help your service agents to communicate more efficiently with your customers.

AI and analytics can be used to help your customer service agents make informed service decisions on behalf of your customers.

- Unsatisfactory resolution times

Disparte and aging processes and technology make it hard to resolve customer issues in a timely manner.

Asking the same questions again and again when it only needs to be done once can lead to a frustrated customer and a negative customer experience.

Investing in systems and processes that connect all departments and make customer data easily accessible for your employees can lead to faster resolutions.

Kapture CRM can help you to integrate all relevant customer data from across various departments and bring it to your service agents in one convenient central interface.

17. Work on customer loyalty

You should realize that customer loyalty is as important as bringing in new customers.

You should know that loyal customer can act as unofficial brand ambassadors. Their praise of your company can bring in new clients and enhance your company’s name.

Work on your loyalty programs, improve your customer service, create reward programs, and basically make the customer experience as enhanced as possible.

18. Give yourself some ‘me time’

Dealing with customers can be a roller coaster ride. Some will be a pleasure to deal with while some will be super taxing.

Taking a breather in between interactions will be beneficial for both you and the customer.

You’ll be able to give ‘all of you’ and not a tired version of yourself to the customer.

Taking a small walk or just listening to some music can rejuvenate you enough for your next customer interaction.

19. Update and upgrade

Keeping yourself updated with the latest industry trends will empower you to be more proactive with your customers.

Upgrading your technical and soft skills will help you to be on top of your game.

You shouldn’t only be updating your customer service agents but also your technology.

Even if you have the best customer service team but old technology, your team will always be at a disadvantage.

As stated earlier using a KMS can really help with updating and upgrading your customer service agents’ knowledge base.

Since a KMS is a categorized central repository of all information related to your company, it makes it easy for your customer service agents to lookup for things that they need information on.

20. Customer-first

Putting the customer first is the essence of customer service. Trying to make the customer experience as enjoyable as possible should be the goal of any organization.

Some companies fail in this regard by trying to push products and services onto the customers.

They prioritize profits over people.

You should train your employees to provide over-the-top customer services and put the customer before the company’s bottom line.

Delivering customer service in financial services is definitely challenging, but by working on the given tips it is possible.

It may take time, energy, and resources for you to reach that goal of providing ‘impeccable customer service’. But when you do it’ll be worth the effort.

Enhancing customer service in financial services

Kapture can help you ease your customers’ pain points through our world-class BFSI CRM.

Expand your customer service agents’ knowledge about your products and services through our KMS.

Its ‘Flash News’ features let your agents know about special product offers while customizable FAQs can help customers with most of their common queries.

Thus, saving time and energy for both your agents and customers.

Training them through our LMS ensures that they stay on top of their game. Create quizzes for your service agents. Monitor their progress and assess their performances.

Any identified gaps can be addressed by gaining access to the centralized learning materials and video repository.

With the help of our CRM, managing customer data among the different departments in your organization will be a breeze.

With the help of our customer data management feature, you’ll be able to merge data from various departments to avoid duplication, segregate customer profiles according to your filters, and come up with customized plans for your customers.

Also, help your customer service agents generate 360° customer profiles through its reporting and analytics tool to create customized products for your customers.

About the Author | |

| Elvis Richard Cormuz |

| Elvis hails from Darjeeling and has had vibrant work life experiences – a musician, social worker and freelance translator/transcriber, his hobbies include music, movies and reading. | |

,

,

,

,

,

,

,

,

,

,

,

,

,