As per Forrester’s European Banking Customer Experience Index (1), quick settlements of customer inquiries, simple language customer communication, and speedy payment processing are the primary determinants of customer retention in banking.

The integration of voice bots in the banking process can streamline all of these aspects of customer service experiences.

According to a Strategy and study at PWC, banks can increase their efficiency by up to 35% by implementing voice AI in their front-end and back-end operations.

Further, voice bots transform CX in banks by offering an encrypted and secure communication channel.

Read on to learn more about the high-end impact of a voice bot in banking. From real-life use cases to effective implementation tips, we have enlisted key points of voice banking in this blog.

What Is Voice Banking?

Voice banking is the application of artificial intelligence technology to allow users to communicate with their bank or financial institution using voice commands.

Through natural language chats, this technology enables users to carry out various banking functions, including

- Paying bills

- Transferring funds

- Checking account balances

- Receiving individualized financial advice

In banking, voice artificial intelligence (AI) uses speech recognition technology to comprehend and interpret customer orders. After processing this data, the AI system obtains pertinent information from the bank’s systems and either completes the requested transaction or gives the user the requested information.

Furthermore, natural language processing skills can be included in voice AI in banking to comprehend the context of the interaction and offer tailored recommendations.

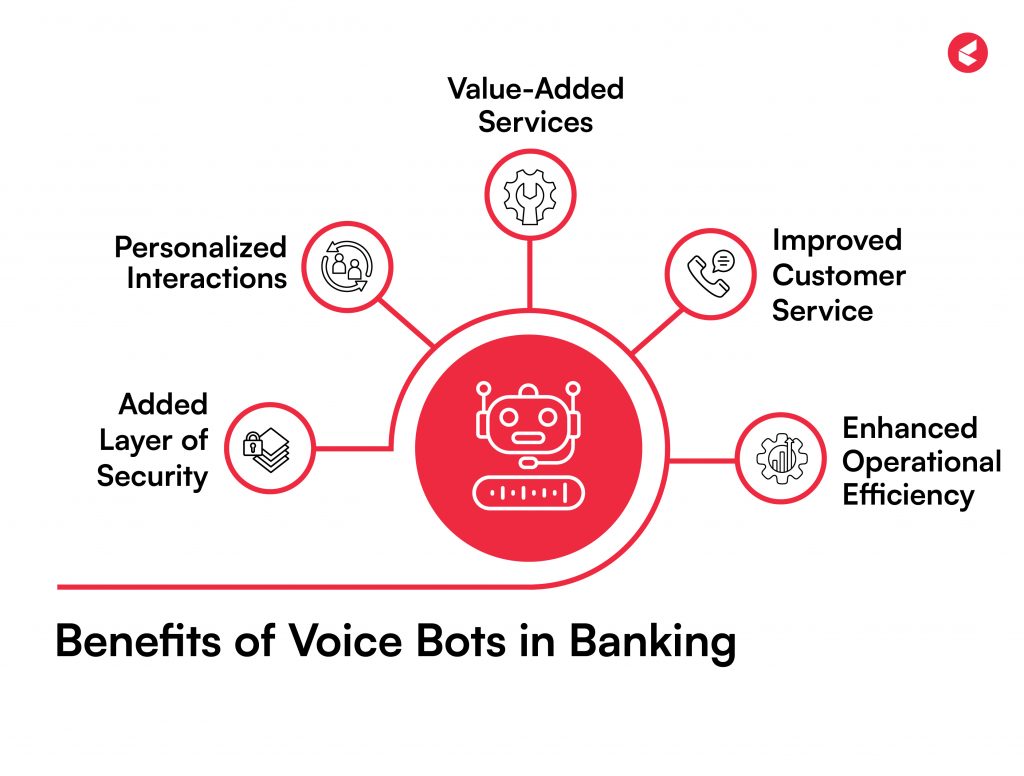

Benefits of Voicebots in Banking

Voice bot integration in the banking industry has many benefits that revolutionize how banks communicate with customers. Some of the top advantages are:

1. Added Layer of Security

To protect sensitive client data and combat fraud, a voice bot in banking is equipped with cutting-edge security features like:

- Voice biometrics

- Multi-factor authentication

- Encryption protocols

Voice bots guarantee safe access to accounts and transactions by using voice recognition technology to confirm users’ identities.

2. Improved Customer Service

Voice bots give users immediate access to information and answer questions without making them wait in line or using complicated IVR systems.

By providing round-the-clock assistance, voice bots ensure customers can access financial services whenever convenient, raising customer satisfaction levels.

3. Personalized Interactions

Voice bots can be programmed to recognize individual customers and tailor responses based on their transaction history. This personalized approach helps build stronger relationships with customers, who feel valued by the bank.

Additionally, voice bots can increase cross-selling opportunities and boost customer engagement by providing appropriate guidance and solutions.

4. Enhanced Operational Efficiency

Voice bots free up human agents’ time to concentrate on more difficult problems by automating repetitive processes like

- Account updates

- Fund transfers

- Balance inquiries

- Bill payments

The bank saves time and resources and minimizes errors due to this automation. Furthermore, voice bots can also manage a large number of customer interactions at once, guaranteeing scalable service delivery.

5. Value-Added Services

Financial institutions need to provide consumers with tailored services to create an impact in the competitive market. For instance, banks can offer devoted clients a unique service like activating cards for overseas use. Voice bots can explain these services to clients using features like automatic outbound calling.

An AI voice bot in banking can also assist in reminding clients of outstanding tasks, setting up automated payment reminders, and more. These discussions seem to happen instantly, which gives the dialogue a more genuine sense.

6. Credit Score Evaluation

Evaluating credit scores is typically a laborious and intricate process. However, an AI voice bot can provide insights about credit limits and how to raise them more quickly, given that it has access to all customer financial data.

Customers will be aware of their financial situation and the maximum credit sum they are eligible to apply for. This will enhance accurate data processing in the lending process.

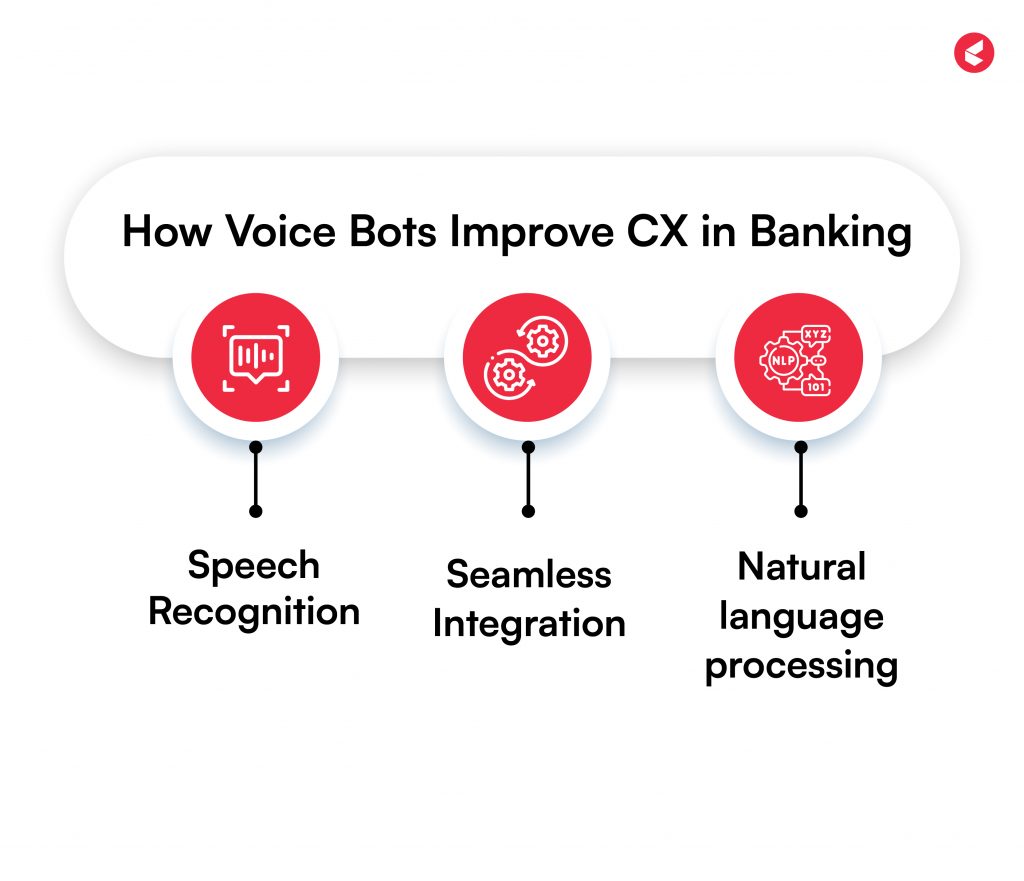

How Voicebots Improve Customer Experience in Banking?

Recent years have seen rapid advancements in artificial intelligence, which have influenced fundamental technologies that are changing how banks interact with and satisfy their customers’ demands.

Here are several ways voice bots enhance customer experience (CX) for banking customers:

1. Speech Recognition

Thanks to AI-powered speech recognition technology, voice-based customer interactions are now far more accurate and efficient. This innovation allows banks to provide interactive voice bots, increasing customer accessibility and convenience.

Customers can now check account statuses, make payments, transfer money, and get individualized financial advice by communicating with their banks using voice commands.

2. Natural language processing (NLP)

A voicebot in banking can converse with customers in a more organic and human-like manner by using Natural Language Processing (NLP) to comprehend and interpret spoken language.

By facilitating quicker query resolution and individualized support, this feature improves customers’ banking experience.

Additionally, voice bots with natural language processing (NLP) capabilities can adjust to various accents, increasing customer satisfaction.

3. Seamless Integration

Seamless integration of a voice bot in banking provides consistent interaction across various touchpoints.

Thanks to this integration, customers can easily switch between voice commands, mobile apps, websites, and other channels to receive the same degree of service regardless of the platform they use, which makes banking more convenient.

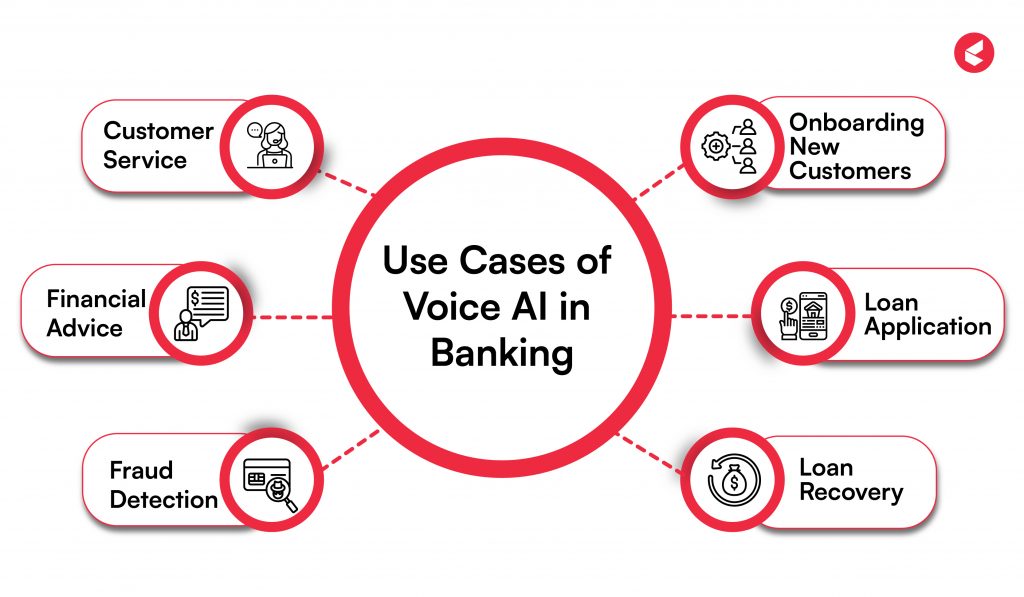

Use Cases of Voicebot in Banking

Here is a comprehensive overview of the key use cases for voice banking:

1. Customer Service

Chatbots can answer numerous customer questions, including those about accounts, statements, money transfers, and card setup. They offer round-the-clock assistance and cut down on client wait times by using natural language processing (NLP) to comprehend user inquiries and deliver precise answers.

In addition to answering FAQs and offering information about extra banking services or amenities, the voice bot can assist users in navigating online banking portals.

It can also actively contact clients to provide tailored advice or support depending on their banking habits.

2. Onboarding New Customers

By offering individualized support and assisting users with account setup, a conversational AI chatbot can greatly expedite the integration procedure for new banking clients.

Here is how a voice bot in banking works to seamlessly onboard new customers:

- Help users provide what is needed, including contact data and personal credentials, throughout the account registration procedure

- Speed up authentication processes by seeking and confirming user-identifying documents, such as driver’s licenses, passports, or government-issued IDs

- Assist users in submitting documents, confirm the legitimacy of papers provided, and highlight any inconsistencies or mistakes for additional examination.

- Simplify the process of creating account numbers, establishing login credentials for Internet banking, and providing debit or credit cards

3. Loan Application

Applications for loans and credit can require extensive documentation and take a long time. Voice bots simplify these procedures, improving client satisfaction and expediting approvals.

Here is how conversational AI functions to streamline loan applications in banks:

- Provides instant support to clients with loan eligibility verification and uploading documents

- Automatically fills out forms by gathering necessary data from ongoing discussions

- Minimizes follow-up questions by offering immediate loan application status information

By digitizing these processes, banks can expedite loan authorizations and increase the pace of decision-making. The approach is straightforward and effortless for customers.

4. Loan Recovery

Voice bots improve the automation of loan recovery procedures and the pre-and post-delinquency phases of debt, which typically require a lot of time and money.

Banks can use an AI Voice Bot to customize consumer outreach and implement a successful debt recovery procedure to enhance the borrower’s payback journey. This includes steps like:

- Reaching out to borrowers via phone calls or voice messages to remind them of upcoming deadlines

- Engaging with borrowers in a conversational manner, providing personalized assistance

- Tracking trends to optimize the various loan recovery strategies

5. Fraud Detection

Banks are very concerned about preventing and detecting fraud, and voice AI bots can improve security protocols. Voice bots can assist in the detection of fraudulent activity by examining speech patterns and voice features.

For example, a bot can begin extra verification procedures or notify the bank’s security team if it detects questionable activity or a voice that conflicts with the cardholder’s profile.

By taking a preventive approach to fraud identification, banks can boost their overall safety and prevent financial damage.

6. Financial Advice

Voice banking can offer customized suggestions based on users’ spending habits and investing interests by combining them with financial data and utilizing AI algorithms.

For instance, a customer can speak to a voice bot to get advice on investment possibilities; the voice bot will assess the customer’s financial status and provide personalized recommendations.

Customers gain insightful knowledge and direction from this, which eventually aids in their decision-making around money.

7. Product Cross-selling

Conversational AI systems can generate comprehensive customer profiles by analyzing past transactions, behavioral trends, and customer data.

Artificial intelligence (AI)- driven systems can recognize pertinent cross-selling possibilities and customize product recommendations by grasping each customer’s financial requirements.

Voice bots can consider customers’ particular preferences to strategically recommend banking products and services, including investment alternatives, credit card deals, savings accounts, and insurance.

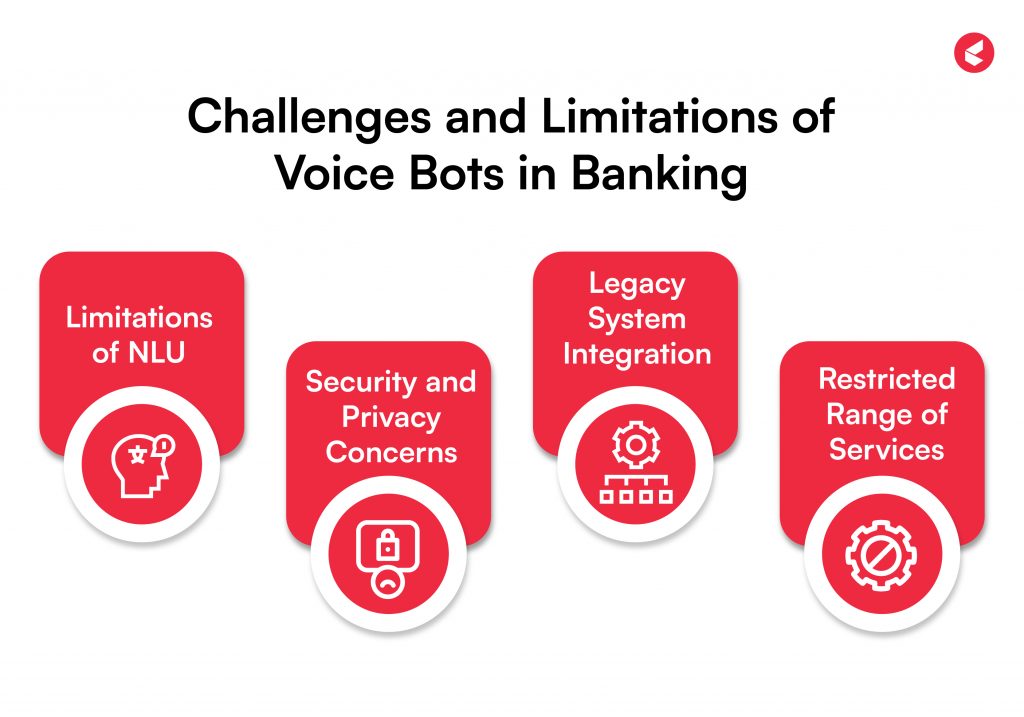

Challenges and Limitations of Voicebot Technology in Banking

There are a lot of prospects for improving customer service and operational efficiency in banking with voice bot technology. However, several challenges prevent its broad use:

1. Limitations of Natural Language Understanding (NLU)

Voicebots frequently have trouble comprehending complex human languages, such as idioms, accents, and slang. Customers can become frustrated and lose trust as a result of this misreading of their questions.

2. Security and Privacy Concerns

Banking transactions are often sensitive, raising concerns over data security and user privacy. Robust authentication processes must be put in place as voice recognition alone may not suffice to prevent fraud.

3. Legacy System Integration

Many banks still use outdated systems that are difficult to integrate with contemporary voicebox technology. This reduces voice bots’ efficacy by making it difficult to retrieve real-time data and provide individualized services.

4. Restricted Range of Services

At the moment, voice bots are mostly employed for straightforward jobs like answering frequently asked questions or balancing queries. It may take a lot of resources to develop powerful AI and make ongoing enhancements to increase their capacity to manage increasingly complicated banking services.

The Future of Voicebot in Banking

Voicebot in banking have a bright future ahead of them owing to the quick development of AI technology. As AI develops further, voice bots are anticipated to advance in sophistication, offering even more organic and intuitive customer interactions.

Thanks to improved natural language processing (NLP), these bots will comprehend and reply to intricate inquiries with increased precision and contextual understanding, streamlining and expediting customer interactions.

Voice bots will help customers remain vigilant about their financial health by providing timely notifications and tailored financial advice. As voice bots improve in recognizing and reducing hazards in real time, their use in detecting scams will also grow.

Implementing Voice AI with a Customer Experience Focus

Here are the key implementation tips to ensure a successful integration:

1. Voice Biometrics

The banking industry places a high premium on security, which voice AI improves with biometric authentication. Voice biometrics can identify a person by analyzing the distinctive features of their voice, providing an extra degree of protection compared to conventional PINs.

2. Omnichannel Consistency

Banks can improve their omnichannel approach by guaranteeing uniform client experiences across all platforms. They should offer seamless service whether the customer interacts with a website from a desktop or calls from their handheld devices.

3. Simple Deployment

As voice AI solutions are simple to set up and maintain, banks can swiftly adopt new technology. With regular updates and user-friendly interfaces, IT professionals can administer these systems more easily and with less interruption to business operations.

4. Bias Minimization

Voice AI systems in banking need to include built-in bias mitigation techniques to guarantee equity and prevent unfair transactions.

Banks can ensure that voice AI systems offer fair, impartial services to all clients by utilizing a variety of databases and implementing ethical AI procedures.

Wrapping Up

Voice bots can initiate outgoing calls to interact with customers. It can pre-screen customers for particular goods or notify them of their payment due times. Banks can ask specific questions or share data with voice bots without coming across as robotic or annoying a customer because they can have natural, human-like interactions.

On this note, you can scale up customer service experiences in the banking sector by partnering with Kapture CX. From accurate, personalized support to automating realistic experiences, we provide advanced AI voice bots with NLP capabilities to elevate the quality of customer service.

Book a demo call with us to learn more about our AI-powered voice bot solutions!

FAQs

A voicebot in banking is an AI-powered virtual assistant that interacts with customers through voice commands. It handles inquiries, processes transactions, provides account information, and assists users with various banking services.

Voice bots offer round-the-clock assistance, enabling rapid access to information and services. They manage a high volume of queries concurrently and lighten the workload for human agents, all of which contribute to more effective service.

The key benefits include enhanced customer engagement, reduced operational costs, improved response times, and increased accuracy in handling requests.

Yes, reputable voicebots use advanced security protocols, including multi-factor authentication to ensure that sensitive customer data is protected during interactions.

Yes, voicebots can be integrated with existing banking systems. This enables them to provide seamless customer service experiences across various platforms.