Lend Smarter, Serve Faster, and Be Every Customer’s First Choice

Deliver speed, personalization, and seamless omnichannel support to meet the evolving demands of today’s borrowers. With Kapture, transform every interaction into an opportunity to build trust, drive engagement, and elevate your lending experience.

Leading Lending Enterprises Trust Kapture

Social Proof

Satisfied Customers Sharing Their Experiences

Take a look at how Kapture makes a real difference.

“ Shivangi Modi of Incred Finance talks about her experiences with Kapture CX, from onboarding all the way to implementation and how much her agents enjoy working on the platform.

Shivangi Modi

Manager Central Operations and Customer Service

Products

CX Solutions That are Crafted to Perfection

An enterprise-ready, Gen AI-powered customer experience platform with a deep focus on customer support automation. Transform good experiences into great ones, wherever your customers are!

Build Trust With Seamless Experiences

Build Trust With Seamless Experiences

Let borrowers check eligibility, upload documents, and get instant answers—all without waiting for assistance.

Offer real-time EMI schedules, payment statuses, and seamless online payment options at their fingertips.

Let customers clear dues, negotiate repayment plans, or reschedule payments effortlessly on their own.

Engage borrowers with personalized loan options and on-demand answers that match their financial goals.

Simplify early terminations with instant cost breakdowns, clear penalties, and streamlined processing.

Less Effort, Better Experiences

Less Effort, Better Experiences

Equip agents with a unified view of customer profiles, loan details, payment history, and more.

Resolve complex issues accurately – contextual responses, next best action, access to support articles & smart automations.

Help agents identify and offer personalized upselling and cross-selling options during live customer interactions.

Streamline dispute handling with pre-filled templates, automated workflows, and accurate resolutions.

Break silos with an integrated platform that connects agents with credit, collections, and compliance teams effortlessly.

Every Interaction, Decoded

Every Interaction, Decoded

Automate QA to evaluate every interaction for compliance, tone, and resolution accuracy, ensuring consistent agent performance.

Provide agents with actionable insights and targeted improvement suggestions to elevate their service delivery.

Leverage AI to create instant, context-rich summaries, saving agents time and speeding up follow-ups.

Uncover customer preferences, pain points, and patterns with advanced intelligence for personalized engagement.

Plan ahead with AI-driven CX load forecasting to optimize resources and reduce wait times during peak periods.

Kapture’s Customer Service AI

KAI: Intelligent. Intuitive. Insightful.

Built on billions of customer interactions and powerful technology, Kapture’s AI understands the importance of customer and employee experiences and offers you personalized support to start making a difference right away.

KAITestimonials

Voices of Trust Across The Industry

Hear from industry leaders about the impact of our platform in delivering seamless experiences and driving success.

Kapture CX’s smooth implementation and dedicated SPOC made onboarding a breeze. Their commitment to timelines ensured our automations launched perfectly, empowering us to deliver a best-in-class customer experience.”

Spokesperson

Progcap

Advantages

With Kapture

Everyone Wins

A platform loved by customers, agents, and businesses.

- Long wait times for urgent loan queries.

- Repetitive explanations across disconnected channels.

- Limited options for self-service resolutions.

Faster Automated Resolutions: Conversational AI Bots respond and resolve most queries instantly with empathy.

Seamless Omnichannel Experience: Consistent and contextual support is provided through self-service options and unified customer profiles.

Real-time Updates & Automated Processes: Customers can check payment statuses, upload documents, manage payments, and more, easily.

- Disorganized workflows and hard-to-access customer data.

- Time wasted on writing responses and searching for resolutions.

- No real-time support or feedback during interactions.

Unified Dashboards: One screen provides instant access to customer profiles, loan details, and more.

AI Assistance: Agent Assist & Co-pilot refines and suggests contextual responses, recommends the next best action, offers instant access.

Performance Feedback: Auto QA and targeted feedback help agents improve compliance and first-contact resolutions.

- High support costs from inefficient processes.

- Limited insights into customer behavior and team performance.

- Poor resource planning during peak times.

Bring down expenses with AI: Smart self-service and automation deflects routine queries, reducing agent workload and support costs.

Ensure quality across the board: Leverage automated QA to maintain consistent service standards across teams, across any channel.

Data-driven decisions: Advanced analytics provide actionable insights on customer preferences, sentiments, and other operational metrics.

Security & Compliance

Enterprise-grade Security & Compliance

At Kapture, security and compliance are at the core of everything we do.

- AES-256 bit encryption for robust data security

- TLS 1.2 for secure communication

- PHI/PII masking to protect sensitive information

- Periodic VAPT (Vulnerability Assessment & Penetration Testing) Assessment

- Built on OWASP Secure Code Standards

- Fully compliant with DPDP regulations

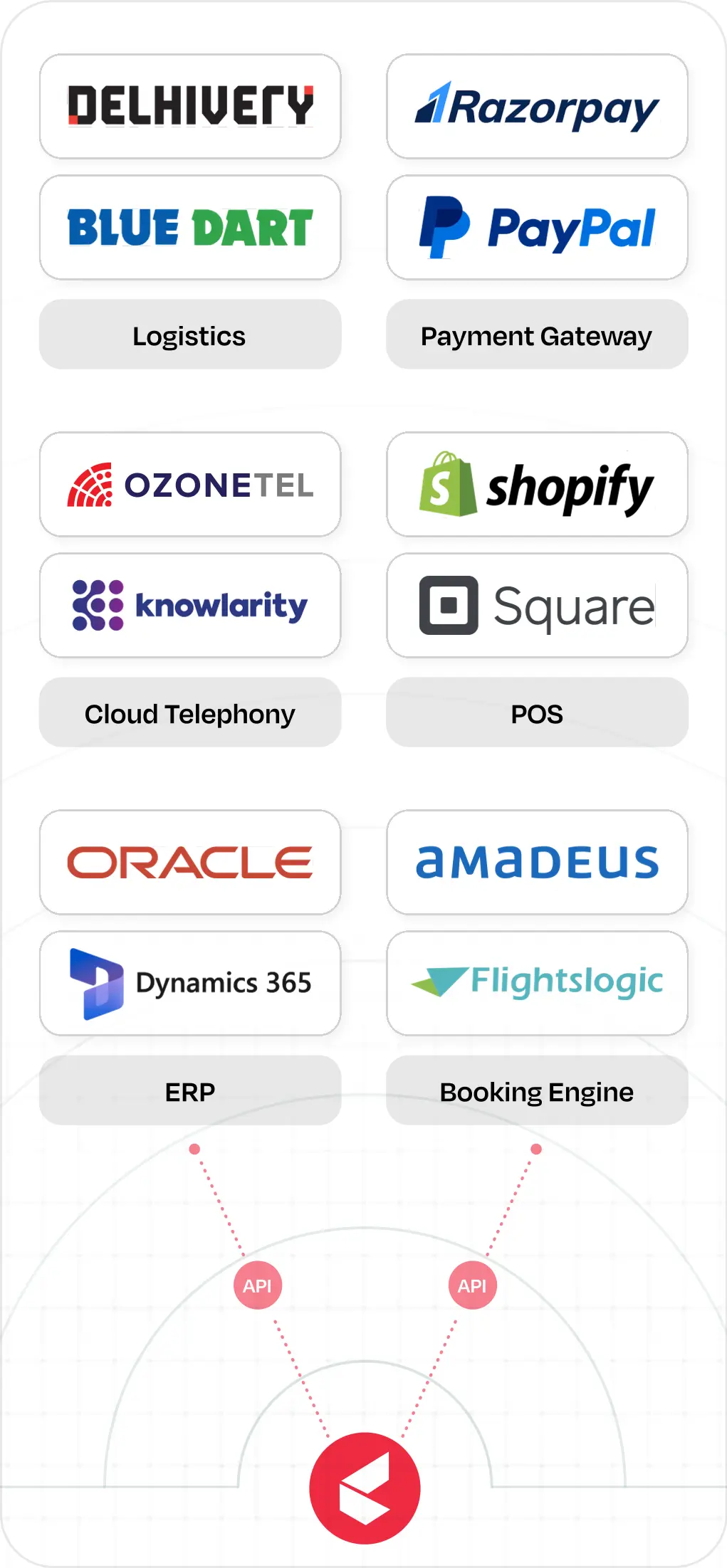

Integrations

Connect Seamlessly to the Tools Your Teams Use Daily

Data is useless when it’s hard to access. Kapture integrates with the tools your teams use daily providing quick and easy access to customer insights. Unified visibility = better CX. Experience the power of 1000+ out-of-the-box Enterprise API integrations to centralize your support operations.

Find out how Kapture can meet your unique needs today.

Join the 1000+ Enterprises who transformed their CX while reducing support costs.

Get Demo